Defending

your wallet

Ontario’s Lowest Auto Insurance Rates from Your Trusted Broker

Ontario’s Lowest Auto Insurance

Rates from Your Trusted Broker

Liked your quote? Here’s what happens next.

Protection for everything! We’ve got the Car Insurance coverage you need

We work with over 40 of Canada’s Top Insurers to guarantee you have options.

We understand – cheap car insurance is a must have for hard working Ontario families on a budget. When it comes to finding you the best insurance, we look for a little more.

# 1

Finding different ways to save you money

# 2

Ensuring you have the coverage you need

# 3

Choosing insurers with a reputation for exceptional claim service.

Protect your Budget with Gap Insurance

Maintain the original value of your car!

With Gap Insurance, if you buy a new vehicle and it’s written off in an insurance claim, you will get reimbursed for the amount you paid for up to 7 years. If you buy a used vehicle that’s less than ten years old, Gap Insurance will reimburse you for the market value at the time you purchased for up to 5 years.

Questions to Ask Your Broker About Auto Insurance

You need a broker for finding auto insurance that meets your specific needs. Here are a few questions to consider beforehand as you prepare for the discussion:

- How much can you afford to pay if you get in an accident?

(To keep premiums low you may want to have a higher deductible and be willing to pay more for repairs.)

- What is the procedure for filing and settling a claim?

(Ask who to call and what happens after you file a claim.)

- What is the insurance company’s level of service and ability to pay claims?

- What discounts are available?

(Ask about good driver, multiple policy and student discounts.)

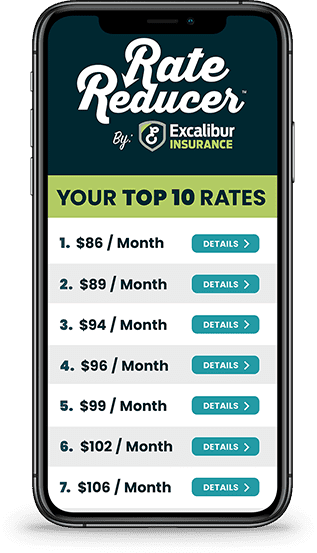

Customer Tool Chest

- Instantly access your pink liability cards.

- View policies via your mobile device.

- Request changes, check claims & more.

- Get your policy renewal digitally.

A few of the reasons we Smile .

Frequently Asked Questions

If you’ve got Auto Insurance questions – we’re here to answer them. Our team of defenders is always happy to help clarify your insurance knowledge and here are a few Tips and Frequently Asked Questions to get you started.